Overview

ELP’s market leading Tax practice with its “out of the box” solution providing ability has created a niche for itself. The Tax practice offers comprehensive qualitative services across both indirect and direct taxes (including transfer pricing) covering the entire spectrum of transactional, advisory and litigation work. Our distinctive tax practice seamlessly integrates expertise in both advisory services and litigation, enabling the firm to address and offer redressal in any and all disputes that may arise. ELP has the distinction of having assisted some of the largest global conglomerates on a wide spectrum of matters that encompass not only legal advisory but also in-depth strategic decisions which have had a far reaching impact on domestic as well as cross-border businesses and transactions of these organisations. Our tax team comprising of professionals with diverse expertise, which include not only legal professionals (advocates and solicitors) but also financial and market analysts, chartered accountants and economists who hold multi-jurisdictional qualifications, has achieved this kind of reach and impact with a rather innovative and customised approach.

Additionally, ELP’s team routinely renders litigation services to clients. ELP strategises, assists and represents clients in both adjudication as well as appellate proceedings. We regularly handle cases from the stage of appearing before Assistant or Deputy Commissioners right up-to the Supreme Court on almost every tax issue to have arisen in the country. Our team has the expertise and ability to represent clients at various fora, including the Dispute Resolution Panel, Authority for Advance Rulings and the Supreme Court of India. The combination of advisory and litigation services provided under one roof gives ELP a unique positioning especially in India, where the proportion to tax litigation is significantly higher compared to the other nations.

ELP’s indirect tax expertise has transitioned itself from the entire gamut of taxes including Excise, Customs, Service Tax, Sales Tax/Value Added Tax (VAT), Entertainment Tax, Entry Tax to recently introduced Goods and Services Tax (GST). On GST, ELP has to its credit not just the privilege of having assisted companies with transitioning into GST, but in certain cases hand held the entire industry in the transition process. ELP also advises clients on Foreign Exchange Regulations, Foreign Trade Policy and Export Control and Trade Sanctions. Our wealth of experience includes advising clients across sectors and countries. We have also successfully represented various industry associations before the Ministry of Finance and its functionaries on various issues impeding business operations. We have also been privileged to advise the Government of India on policy initiatives.

ELP’s direct tax expertise covers all aspects of international and domestic tax matters including transfer pricing. Our team outlines commercially viable structures and suggests arrangements to clients so as to achieve business objectives in a tax and regulatory efficient manner. We provide cutting edge and novel solutions to issues that emanate at the structuring stage of transactions with the view to providing forward looking tax strategies to our clients.

ELP’s transfer pricing services offer solutions across industries and geographies with the focus on not only a comprehensive analysis but also on assisting clients in planning their transfer price. We are uniquely positioned amongst firms in India due to our added ability to advice on trade and customs including valuation to be adapted under customs. Our team has been trained internationally and is able to provide a broader perspective on matters and transactions to mitigate risks in the future.

With years of unparalleled expertise in the field of Indirect Tax Advisory and Litigation, ELP brings to the table a dedicated and experienced team of professionals comprising of advocates, chartered accountants and economists to provide high quality support, advice and assistance towards a smooth transition into the new GST regime. Our in-depth understanding of this field has led us to collaborate with various large multi-national and Indian clients across diverse sectors, industry associations and trade bodies. Our presence in multiple locations in India and proficiency in the management of multi-jurisdictional tax advisory and litigation matters enables us to provide Pan-India support to clients on GST.

ELP’s integrated and seamless approach, wealth of experience, high-level partner involvement, in-depth knowledge and expertise and comprehensive service offerings pan India have made us one of the most sought after firms for tax within India.

Services

Indirect Tax

- Tax structuring & optimisation including advice and assistance in relation to all kinds of issues, having implications under GST as also in relation to:

- Customs Duty

- State Excise, and State incentive policy

- Foreign Trade Policy, etc.

- Export Control and Trade Sanctions

- Advisory, transaction structuring & support services including analysis of sourcing, procurement and distribution models and advice on best practices to be incorporated in the supply chain from a GST efficiency perspective

- Due diligence & optimisation study for building tax efficiencies and determining potential tax saving opportunities

- Assistance for negotiating optimum package of incentives under the State Industrial Policy

- Comprehensive support for resolving tax issues related to cross border transactions

- Advice and assistance on policy initiatives & representations before Central and State Government authorities

- Litigation services – right from assessment level to the highest appellate level, and across all fora and courts including Authority for Advance Ruling, Settlement Commission, up-to the Supreme Court

Direct Tax

International and Domestic Tax Advisory

- Inbound and outbound structuring;

- Planning to improve tax efficiency/strategic documentation;

- Designing an entry strategy (types of presence);

- Treaty interpretations;

- Exchange policy and foreign investments;

- Investment and capital structuring;

- Structuring of Revenue and/or capital flows – for example dividend, royalty, fees for technical services;

- Formulating strategy for mitigating risk of PE exposure of foreign corporations;

- Structuring of infrastructure and Engineering Procurement Construction (EPC) contracts;

- Domestic Tax Planning;

- Tax compliance & dispute assistance (litigation support);

- Levies from POEM and GAAR perspective

Transfer Pricing

- Transfer pricing study and documentation;

- Inter-company transfer pricing policies for tangible goods, intangibles and services;

- Transfer pricing planning Services;

- Transfer Pricing Litigation;

- Supply chain advisory;

- Analysing existing policies to ascertain how these should be streamlined to meet the changing economic environment; and

- Evaluating the positions taken in past in light of the evolving tax positions

Financial Planning and/or Transaction Advisory

- M&A Advisory;

- Promoter off-shoring;

- Structuring for listing outside of India;

- Fund structuring and Carry structuring;

- Internal restructuring, and

- Transaction process support

Thought Leadership

The Renegotiation of the India-Mauritius Treaty: Implications for Tax Planning and Investment

24 Apr 2024 |

Read More

I-T dept starts drive to dispose of appeals, 0.54 million at last ...

22 Apr 2024 |

Read More

India-Mauritius DTAA Changes May Decrease FPI Inflows from Mauritius: Experts

17 Apr 2024 |

Read More

Taxmen wary of protocol to amend India-Mauritius DTAA; raise concern over enhanced ...

15 Apr 2024 |

Read More

Questioning Morality: The Classification Dilemma of Massagers as Adult Toys

12 Apr 2024 |

Read More

India-Mauritius Amend Tax Treaty: Foreign Investments to Come Under Close Scrutiny

11 Apr 2024 |

Read More

Asia Tax Updates Webinar Series: Australia, China, India, Indonesia and Singapore

25 Apr 2024 |

Read More

Penny stocks linked tax evasion: Tax dept may take you to tribunal ...

8 Apr 2024 |

Read More

Stamp Duty to be levied on Delivery Orders: Bombay High Court gives ...

5 Apr 2024 |

Read More

TDS deduction: Why you must check status of PAN Aadhaar linking status ...

4 Apr 2024 |

Read More

Riding the waves of change: Challenges in the real estate sector post-GST ...

3 Apr 2024 |

Read More

Income tax notices lead to stress among startups, executives and investors

2 Apr 2024 |

Read More

Record GST collection led by resilient economy; Elections to boost momentum, say ...

2 Apr 2024 |

Read More

CBIC’s GST investigation guidelines, a consolidation of prior provisions: Experts

2 Apr 2024 |

Read More

Clifford Chance scores a victory against Tax Department

28 Mar 2024 |

Read More

Now a VIP or PMO can help you to expedite pending tax ...

20 Mar 2024 |

Read More

ITR filing 2023-24: 5 ways you can reduce your income tax burden

20 Mar 2024 |

Read More

Register for our Webinars on 21 March 2024 : Global Perspectives on ...

26 Feb 2024 |

Read More

Register for our Webinars on 19 March 2024 : Global Perspectives on ...

26 Feb 2024 |

Read More

Supply of medicines, drugs, consumables, food to in-patients of a hospital to ...

19 Feb 2024 |

Read More

How selling equities before March 31 can help you save income tax

17 Feb 2024 |

Read More

Amendments In ITA,1961 Making MSMEs & Big Corporates Jittery

15 Feb 2024 |

Read More

GST Council may issue clarification on expat salary taxation amid controversy

13 Feb 2024 |

Read More

SAT may have to hear afresh many important cases

25 Apr 2024 |

Read More

Why startups are flipping back to India in spite of the hefty ...

9 Feb 2024 |

Read More

Impact of Interim Budget 2024 on different sectors

7 Feb 2024 |

Read More

Interim Budget 2024: Elements of progressiveness & populism, forward-thinking & optimism

7 Feb 2024 |

Read More

It’s Dateline India for new SaaS startups

6 Feb 2024 |

Read More

Interim Budget 2024: Scope of amendments proposed in provisions governing Input Service ...

3 Feb 2024 |

Read More

Budget 2024 Announcement on withdrawal of petty direct tax demands unlikely to ...

3 Feb 2024 |

Read More

Budget Bulletin - Taxation

1 Feb 2024 |

Read More

Interim Budget 2024 Expectations: Process Simplification for Ease of Doing Business and ...

1 Feb 2024 |

Read More

Decriminalise more provisions in tax laws in Budget 2024, say lawyers and ...

1 Feb 2024 |

Read More

Concessional corporate tax rate of 15% for eligible ‘start-ups’ has not been ...

1 Feb 2024 |

Read More

Income Tax Budget 2024 Live Updates: No change in slabs, both new ...

1 Feb 2024 |

Read More

Income tax slabs 2024-25: Budget 2024 to tweak new income tax regime?

1 Feb 2024 |

Read More

Interim Budget 2024 & stock market wishlist: Removal of STT, double taxable ...

1 Feb 2024 |

Read More

How largecap indices Sensex, BSE100 fared on Budget days in last 12 ...

1 Feb 2024 |

Read More

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

31 Jan 2024 |

Read More

Budget 2024 Expectations for Central Government Employees, Income Tax Payers: Will these ...

31 Jan 2024 |

Read More

Budget 2024: Expectations - Here's what EV industry expect from Union Budget ...

31 Jan 2024 |

Read More

Taxand : Transfer Pricing Guide 2024 – India Chapter

31 Jan 2024 |

Read More

Taxand : Transfer Pricing Guide 2024

31 Jan 2024 |

Read More

Income Tax Slab and Rates in Budget 2024 LIVE: Wishlist of salaried ...

31 Jan 2024 |

Read More

HC holds provisions of anti-profiteering under GST

30 Jan 2024 |

Read More

Direct Tax to Total Tax Collection Dipped 270 Bps in Past Decade: ...

30 Jan 2024 |

Read More

Budget expectations: What Middle Class can expect from FM Nirmala Sitharaman? Here's ...

30 Jan 2024 |

Read More

Budget Expectations: Will Standard Deduction see a revision in Interim Budget?

29 Jan 2024 |

Read More

Interim budget 2024: Will Section 80C deduction limit increase from Rs 1.5 ...

18 Jan 2024 |

Read More

THE GST ODESSEY: Litigation and the Art of Sailing Through

25 Apr 2024 |

Read More

Interim budget 2024: Can taxpayers expect relief? 5 anticipated changes

16 Jan 2024 |

Read More

Interim Budget 2024: Sector-wise wishlist, stock market tax sops, divestments & more ...

15 Jan 2024 |

Read More

Lack of taxation clarity may cloud resident Indians’ plans to invest in ...

14 Jan 2024 |

Read More

Budget 2024: Will the government revise taxes on employee stock ownership plans?

12 Jan 2024 |

Read More

SC stays Delhi HC ruling on benefits for foreign investors with TRCs

12 Jan 2024 |

Read More

Gold Jewelry Industry - Standard Operating Procedures

10 Jan 2024 |

Read More

Employees will need to pay tax when they exercise the options and ...

25 Apr 2024 |

Read More

Supreme Court To Decide On Validity Of TRCs As Sufficient Proof To ...

5 Jan 2024 |

Read More

Food Fight: Zomato may be looking at minimum 3 yrs of litigation ...

23 Dec 2023 |

Read More

Zomato told to cough up Rupees 401 crore as GST on delivery ...

25 Apr 2024 |

Read More

Relief to MNCs: CBIC relaxes rules for secondment cases

15 Dec 2023 |

Read More

You can discard tax returns if your ITR status is 'unverified'

5 Dec 2023 |

Read More

Indirect Tax Newsletter - October 2023

30 Nov 2023 |

Read More

The GST Council’s power on classification of products

30 Nov 2023 |

Read More

What GST Scrutiny on delivery partner fees means for Zomato & Swiggy

29 Nov 2023 |

Read More

Several mergers and acquisitions on halt as India Inc checks tax liabilities ...

22 Nov 2023 |

Read More

The India Post - November 2023

23 Nov 2023 |

Read More

GST net widens for real estate firms

21 Nov 2023 |

Read More

Delhi HC quashes reassessment orders for AY 2016-17, 2017-18 having tax escapement ...

21 Nov 2023 |

Read More

E-way bill generation surges to all-time high of 10.03 cr in Oct

6 Nov 2023 |

Read More

What is agricultural income, different types of agricultural income?

31 Oct 2023 |

Read More

Centre notifies 18 % GST on corporate guarantees

30 Oct 2023 |

Read More

Denial Of Tax Benefits Under French, Swiss, Dutch Treaties: A Showcase Of ...

25 Oct 2023 |

Read More

SC rules on interpretation of tax treaty – notification mandatory for MFN ...

24 Oct 2023 |

Read More

LIBOR Transition in India Should Prompt Businesses to Prepare

18 Oct 2023 |

Read More

India’s New Trade Policy: Prospects and Challenges for Exporters

12 Oct 2023 |

Read More

Indirect Tax Newsletter - September 2023

11 Oct 2023 |

Read More

How treasury bills returns are calculated, taxed: Learn this to maximise gain ...

9 Oct 2023 |

Read More

ELP Podcast Series- GST on Employee Stock Options (ESOPs)

9 Oct 2023 |

Read More

Refund of ITC in Export – A Subject Open to Deliberation

29 Sep 2023 |

Read More

CBDT notifies Valuation Rules for unquoted equity shares and CCPS issued by ...

28 Sep 2023 |

Read More

Business Expenditure - Similarity & Divergence between Income Tax & GST Law

22 Sep 2023 |

Read More

Indirect Tax Newsletter - August 2023

18 Sep 2023 |

Read More

What to do when you get an income tax notice for claiming ...

25 Apr 2024 |

Read More

Development right akin to land purchase, shouldn’t attract GST

14 Sep 2023 |

Read More

File ITR now, pay tax dues later

25 Aug 2023 |

Read More

Can you switch tax regime from previous/ last year when filing belated ...

25 Apr 2024 |

Read More

GST shock for Online Games of Skill: Is there still a chance?

10 Aug 2023 |

Read More

Indirect Tax Newsletter - July 2023

10 Aug 2023 |

Read More

Is India's Inc. recovery too lopsided?

8 Aug 2023 |

Read More

GST on online gaming turnover akin to scoring own goal

2 Aug 2023 |

Read More

GST Council-50* not out

29 Jul 2023 |

Read More

Why do so few Indians pay income tax?

25 Apr 2024 |

Read More

The Legal Maze Solved: Finally, a clarification on the long-disputed issue of ...

24 Jul 2023 |

Read More

E-invoicing – Whether the relevant provisions of GST law require patchwork?

21 Jul 2023 |

Read More

Clarifications pursuant to the 50th GST Council Meeting

20 Jul 2023 |

Read More

Key Recommendations of the 50th GST Council Meeting

13 Jul 2023 |

Read More

Implementation of 28% GST rate will bring challenges to online gaming industry

13 Jul 2023 |

Read More

What are the changes that GST needs?

6 Jul 2023 |

Read More

Indirect Tax Newsletter - June 2023

6 Jul 2023 |

Read More

Taxpayers not opting for new I-T regime must fill Form 10-IEA

22 Jun 2023 |

Read More

ELP Knowledge Series India Update Part 1 of 2023

25 Apr 2024 |

Read More

Indirect Tax Newsletter - May 2023

14 Jun 2023 |

Read More

Tax matters. Income Tax assessees to get 21 days to respond to ...

10 Jun 2023 |

Read More

Food for thought: Restaurants do not need the added spice of GST ...

18 May 2023 |

Read More

Will changes in angel tax rules help start-ups?

30 May 2023 |

Read More

Indirect Tax Newsletter - April 2023

19 May 2023 |

Read More

Statutory Glitches in Online Gaming in India

16 May 2023 |

Read More

Bombay High Court (3rd Judge) has upheld the constitutional validity of Section ...

4 May 2023 |

Read More

India to align with global jurisdictions to regulate cryptocurrency environs

3 May 2023 |

Read More

IDT Newsletter - March 2023

21 Apr 2023 |

Read More

No LTCG tax benefit on these debt mutual funds from April 1: ...

3 Apr 2023 |

Read More

The case for turning India into an aircraft leasing hub

7 Apr 2023 |

Read More

Recent Ruling by Appellate Authority for Advance Ruling

7 Apr 2023 |

Read More

India's Foreign Trade Policy 2023 - An Analysis

1 Apr 2023 |

Read More

Navigating GST 2.0 Issue 16

29 Mar 2023 |

Read More

India Raises Tax on Stock Options to Dampen Retail Frenzy

25 Apr 2024 |

Read More

Indirect Tax Newsletter – February 2023

14 Mar 2023 |

Read More

Expecting a dividend from India – do you qualify for the reduced ...

13 Mar 2023 |

Read More

Expecting a dividend from India – do you qualify for the reduced ...

13 Mar 2023 |

Read More

Key Proposals In The Maharashtra Budget 2023

11 Mar 2023 |

Read More

NPS: Best for Retirement, Tax Saving

6 Mar 2023 |

Read More

Circular on the issue of applicability of service tax on liquidated damages

3 Mar 2023 |

Read More

Payment to Supplier for ITC Availment – An Additional Imposition?

23 Feb 2023 |

Read More

Combine retirement planning with tax saving via NPS, say experts

23 Feb 2023 |

Read More

Key recommendations by the 49th GST Council

20 Feb 2023 |

Read More

Cut GST on metal scrap

16 Feb 2023 |

Read More

General extension to the validity period of conditional Customs exemptions: A task ...

9 Feb 2023 |

Read More

Flipkart Gets Interim HC Relief Over ?1,100 Cr Tax Demand

9 Feb 2023 |

Read More

Indirect Tax Newsletter - January 2023

8 Feb 2023 |

Read More

GST Proposals Such As Restricting Credit on CSR Expenses & Those Relating ...

7 Feb 2023 |

Read More

Budget in a Minute: Key amendments under the Customs laws

7 Feb 2023 |

Read More

Budget in a Minute: Make in India & Enhancing ease of doing ...

7 Feb 2023 |

Read More

Budget in a Minute: Fine print analysis of key proposals for corporate ...

7 Feb 2023 |

Read More

Budget in a Minute: Validity of Conditional Exemptions under Customs

7 Feb 2023 |

Read More

Budget in a Minute: Proposed clarifications on the taxability of online gaming ...

7 Feb 2023 |

Read More

Budget in a Minute: GST affecting the sector of e-commerce

7 Feb 2023 |

Read More

Budget in a Minute: Recent amendments in Gems & Jewellery sector, announced ...

7 Feb 2023 |

Read More

Budget in a Minute: Proposed changes in the infrastructure & energy sector ...

7 Feb 2023 |

Read More

Budget in a Minute: Union Budget 2023: The Misses

7 Feb 2023 |

Read More

Taxation of Online Gaming: Key Union Budget 2023 Proposals and Implications

7 Feb 2023 |

Read More

Budget tax proposal may hit investor returns in REITs

4 Feb 2023 |

Read More

Spotlight: Taxing sin – Budget 2023

6 Feb 2023 |

Read More

Union Budget 2023- A Balanced Scorecard

6 Feb 2023 |

Read More

I-T, TDS to cover cash ‘benefits

3 Feb 2023 |

Read More

India Inc braces for CSR cost blow

3 Feb 2023 |

Read More

Budget 2023, An ‘AI Opener’: Library to Agriculture, FM Sitharaman’s Push for ...

2 Feb 2023 |

Read More

Budget 2023: Tata Steel, Jindal Steel shares climb up to 6% as ...

2 Feb 2023 |

Read More

What does Budget 2023 have for the common man?

2 Feb 2023 |

Read More

Budget Buzz - Alcobev Sector

2 Feb 2023 |

Read More

Union Budget 2023-24 - An Analysis by Economic Laws Practice (ELP)

1 Feb 2023 |

Read More

Budget Buzz - Changes in New Tax Regime

25 Apr 2024 |

Read More

Budget Buzz - Input Tax Credit under GST

1 Feb 2023 |

Read More

Budget Buzz - GST Tribunals

1 Feb 2023 |

Read More

Budget Buzz - TDS u/s 194R on advantage or perquisites allowed

1 Feb 2023 |

Read More

Budget Buzz - Make in India

1 Feb 2023 |

Read More

Budget Buzz - Amendment to the Appealability against Trade Remedial Investigations

25 Apr 2024 |

Read More

Budget Buzz - Tax on winnings from Online Games

1 Feb 2023 |

Read More

Budget Buzz - Impact on the Gems & Jewelry industry

25 Apr 2024 |

Read More

GST: Part-Payment of Tax can’t be pre-condition for bail, says Supreme Court

31 Jan 2023 |

Read More

Transfer of business as a going concern - Reversal of ITC be ...

31 Jan 2023 |

Read More

Navigating the Fiscal Landscape for AIFs and IFSC Funds: Expectations from Union ...

31 Jan 2023 |

Read More

PhonePe investors paid 8000 crores in taxes to make India it's home

27 Jan 2023 |

Read More

Budget 2023: Will FM Sitharaman revise the long-term pending income tax exemptions ...

25 Jan 2023 |

Read More

Placing India at par with the World – Expectations from Union Budget ...

25 Jan 2023 |

Read More

Refund of GST Paid on Notice Pay Recovery – Way Forward

23 Jan 2023 |

Read More

ELP Tax Update - Recent clarifications to settle certain issues under GST

23 Jan 2023 |

Read More

Budget 2023: Indian Corporates Seek a Relook at Buyback Tax

20 Jan 2023 |

Read More

Union Budget 2023 – Keeping direct tax litigation at bay

19 Jan 2023 |

Read More

PAN ID, space parks, IT stocks, basic structure doctrine

17 Jan 2023 |

Read More

Income tax scan. Banks to report every penny paid as interest to ...

12 Jan 2023 |

Read More

Indirect Tax Newsletter - December Edition

11 Jan 2023 |

Read More

GST Clarity On Road Annuity Payments May Brew Fresh Problems

4 Jan 2023 |

Read More

India to Review Rules on How It Taxes Foreign Digital Services

4 Jan 2023 |

Read More

Focus on ‘Uniform Regulation’, What IT Ministry’s Draft Rules on Online Gaming ...

3 Jan 2023 |

Read More

GST: Partial Fix for the Issue of Input Tax Credit Mismatch

30 Dec 2022 |

Read More

ELP Tax Update – Clarifications & Amendments pursuant to the 48th GST ...

29 Dec 2022 |

Read More

Now, claim refunds on cancelled flat booking, insurance policy

29 Dec 2022 |

Read More

Can property tax be imposed on monuments?

21 Dec 2022 |

Read More

Govt to refund GST if purchase of incomplete house called off

20 Dec 2022 |

Read More

ELP Tax Update - Highlights of the 48th GST Council Meeting held ...

19 Dec 2022 |

Read More

Indirect Tax Newsletter - November Edition

8 Dec 2022 |

Read More

Redington’s ‘Dollar Team’ And Ripple Tax Effects on IT Sector

25 Nov 2022 |

Read More

Redevelopment of housing society – GST implications

25 Apr 2024 |

Read More

Who qualifies as Intermediary from a GST standpoint?

17 Nov 2022 |

Read More

Administrative Mechanism in India for Valuation of Related Party Imports- Perspective & ...

17 Nov 2022 |

Read More

ELP Tax Update - Circular issued to clarify aspects relating to Inverted ...

11 Nov 2022 |

Read More

Navigating GST 2.0 Issue 15

2 Nov 2022 |

Read More

Taxability of Support Services for Petroleum Operations under GST

21 Sep 2022 |

Read More

Where Is Your Maintenance Fee Getting Used?

2 Sep 2022 |

Read More

Experts analyse SC’s latest order on Benami transactions

24 Aug 2022 |

Read More

GST: A Strict Framework For Arrests, Bail, Summons Is Here

19 Aug 2022 |

Read More

Sale of Developed Plot- Developers on the Fence

17 Aug 2022 |

Read More

Indian Supreme Court Finds Taxation of Ocean Freight Unconstitutional

12 Aug 2022 |

Read More

Navigating GST 2.0 - Issue 14

10 Aug 2022 |

Read More

GST Circular On Liquidated Damages - Opportunities In Contracts/Claims

10 Aug 2022 |

Read More

Damages have become less damaging

8 Aug 2022 |

Read More

GST Relief For Breach Of Contract, Damages

5 Aug 2022 |

Read More

The decision of the Supreme Court in FILCO Trade Centre Pvt Ltd ...

2 Aug 2022 |

Read More

GST In India The Road Ahead

28 Jul 2022 |

Read More

As July 31 deadline looms, only 50% IT returns filed; tech glitches, ...

25 Jul 2022 |

Read More

Kerala’s GST deviation will need legal backing; council dispute mechanism should kick ...

21 Jul 2022 |

Read More

Karnataka High Court Upholds GST Exemption On Annuity Payments For Road Construction

21 Jul 2022 |

Read More

You may end up getting income tax notice if this document is ...

25 Apr 2024 |

Read More

Guidelines on TDS on transfer of Virtual Digital Assets

19 Jul 2022 |

Read More

Inverted duty structure: Walking towards making GST a good and simple Tax

18 Jul 2022 |

Read More

Taxand : Global M&A Tax Guide 2022 – Complete Guide

12 Jul 2022 |

Read More

Taxand: Global M&A Tax Guide 2022 – India Chapter

12 Jul 2022 |

Read More

Will ITR filing deadline for FY 2021-22 be extended?

12 Jul 2022 |

Read More

Flurry of GST Circulars: Understanding the Changes

11 Jul 2022 |

Read More

47th GST Council Meeting: Analysis by Economic Laws Practice

7 Jul 2022 |

Read More

GST Council’s 47th Meeting- Experts React!

30 Jun 2022 |

Read More

The High Tide of Export Duty on Steel - Evaluating the Consequences

5 Jul 2022 |

Read More

Why buying gold jewellery is set to become expensive: Check here the ...

1 Jul 2022 |

Read More

Taxing gifts — circular adding to confusion

30 Jun 2022 |

Read More

47th GST Council Meet | Analysing GST Council's decision

30 Jun 2022 |

Read More

Five years of GST a mixed bag, a multiplicity of notices troubling ...

16 Jun 2022 |

Read More

Will the Curtains Fall for the One Nation, One Tax Regime?

15 Jun 2022 |

Read More

One Supreme Court Ruling. Two Taxing Consequences

27 May 2022 |

Read More

GST: Cross-Charge Issue Just Got Real

4 Jun 2022 |

Read More

ELP Knowledge Series India Update Part 2 0f 2022

3 Jun 2022 |

Read More

Courts Will Now Have To Be More Proactive In Judicial Review Of ...

24 May 2022 |

Read More

The Bugbear for India’s Online Gaming Industry

23 May 2022 |

Read More

SC rulings to bring relief to importers, clarity on GST Council’s role

20 May 2022 |

Read More

ELP Tax Update - Supreme Court strikes down levy of IGST on ...

20 May 2022 |

Read More

PAN, Aadhaar a must for cash transactions above Rs 20 lakh a ...

13 May 2022 |

Read More

CBDT broadens scope of PAN requirements to transactions

25 Apr 2024 |

Read More

PAN, Aadhaar now mandatory for cash deposits, withdrawals above this amount in ...

11 May 2022 |

Read More

ELP Podcast Series – Blockchain Based Smart Contracts: Key Tech & Regulatory ...

10 May 2022 |

Read More

Navigating GST 2.0 - Issue 13

5 May 2022 |

Read More

Govt seeks to grow tax base, makes filing must for TDS/TCS above ...

25 Apr 2022 |

Read More

GJEPC India’s webinar on ‘GST Audits and Practical Insights of dealing in ...

25 Apr 2022 |

Read More

Have big unexplained expenses? You can face IT review of past 10 ...

19 Apr 2022 |

Read More

GST implications for supplies of goods that are not in “India” at ...

18 Apr 2022 |

Read More

ELP Podcast Series – Non-Fungible Tokens (NFTs) : Understanding the basics

13 Apr 2022 |

Read More

How India's taxmen are chasing global PE funds for misusing tax treaties ...

8 Apr 2022 |

Read More

Manual of Key Judicial Pronouncements - Alcobev Sector - Volume 2

6 Apr 2022 |

Read More

Taxation & The Hospitality Sector

5 Apr 2022 |

Read More

India’s New Regime for Taxing Virtual Digital Assets

23 Mar 2022 |

Read More

Decoding The Constitutional Provisions Behind GST

22 Mar 2022 |

Read More

The demise of Advance Rulings

17 Mar 2022 |

Read More

Unsettling The Settled Doctrine Of Promissory Estoppel – The Ghost Of VVF

3 Mar 2022 |

Read More

ELP Knowledge Series – India Update Part 3 of 2021

24 Feb 2022 |

Read More

India Budget 2022 Overrides Supreme Court Ruling—History Repeats Itself

14 Feb 2022 |

Read More

Simpler tax regime to Covid deduction: common man wants from budget 2022

3 Feb 2022 |

Read More

Budget Speech 2022: Will FM Nirmala Sitharaman address Cryptocurrency regulation and tax ...

3 Feb 2022 |

Read More

Budget 2022: ‘Income Tax calculation on Fixed Deposit and other savings should ...

3 Feb 2022 |

Read More

Income Tax Budget 2022 Highlights: LTCG surcharge rate at 15%, Updated Return ...

3 Feb 2022 |

Read More

Budget 2022: MF industry seen benefiting with digital assets under tax net

3 Feb 2022 |

Read More

Union Budget 2022 disappoints majority of taxpayers

3 Feb 2022 |

Read More

Can the 'source of fund' rule in Budget hinder non-VC investments in ...

3 Feb 2022 |

Read More

Unravelling the Essence of Input Tax Credit

7 Feb 2022 |

Read More

The GST (Googly, Simplification and Tarrifisation) in Customs

7 Feb 2022 |

Read More

FM Budget Mantra: Tax stability leads to buoyancy in revenue, impetus to ...

7 Feb 2022 |

Read More

Modi government gags flow of export-import data

7 Feb 2022 |

Read More

Crytocurrency tax: How will the Budget 2022 rules impact crypto investors?

4 Feb 2022 |

Read More

A tax guru explains all that is wrong with Indian government’s latest ...

4 Feb 2022 |

Read More

No booster dose for pharma sector in Budget 2022

4 Feb 2022 |

Read More

Budget Buzz -Litigation

4 Feb 2022 |

Read More

Budget Buzz - Virtual Digital Assets

4 Feb 2022 |

Read More

Budget Buzz - Tax Deductibility of Education Cess

4 Feb 2022 |

Read More

Budget Buzz - Make in India

4 Feb 2022 |

Read More

Budget Buzz - Gems Jewellery Sector

4 Feb 2022 |

Read More

Budget Buzz - DRI's Power

4 Feb 2022 |

Read More

Budget Buzz - Capital Goods

4 Feb 2022 |

Read More

Budget-2022 No retrospective amendments please!

4 Feb 2022 |

Read More

Budget wish list to augment M&A activity

4 Feb 2022 |

Read More

Union Budget - An Analysis by Economic Laws Practice

1 Feb 2022 |

Read More

Budget 2022: How are NRIs taxed in India and why they want ...

27 Jan 2022 |

Read More

ELP Podcast Series - Unfolding Blockchain Technology and Derivation of Cryptocurrency

25 Jan 2022 |

Read More

India Union Budget 2022: Analysis of Tax, Customs and Regulatory amendments

25 Jan 2022 |

Read More

Income Tax Assessment - It is faceless but not voiceless !

20 Jan 2022 |

Read More

Metaverse – Are Indian Laws Ready

20 Jan 2022 |

Read More

Winter Parliament session: Government to introduce Cryptocurrency Regulation Bill

18 Jan 2022 |

Read More

Clipping Wings and Stalling Engines – Widened Scope of Self-Assessed Tax

13 Jan 2022 |

Read More

Demonetisation,five years later

13 Dec 2021 |

Read More

Gift of Brand to corpus of a private irrevocable trust is a ...

10 Dec 2021 |

Read More

Interpreting The India-US Interim Agreement On Equalisation Levy 2020

30 Nov 2021 |

Read More

Legal Metrology (Packaged Commodities) Amendment Rules, 2021

16 Nov 2021 |

Read More

OECD/G20 framework on global tax: What does it mean for India?

12 Nov 2021 |

Read More

Pre-deposit - mode of payment quagmire

16 Oct 2021 |

Read More

Real estate developers reach out to government over GST on redevelopment

22 Oct 2021 |

Read More

Navigating GST 2.0 - Issue 12

18 Oct 2021 |

Read More

45th GST Council Meeting Highlights

18 Sep 2021 |

Read More

GST Meet on Friday: Petrol, Zomato, Swiggy, Edible Oil, What Could Be ...

17 Sep 2021 |

Read More

ELP Knowledge Series – Part 2 of 2021

15 Sep 2021 |

Read More

The Supreme Court upholds the constitutional validity of rule 89(5) - refund ...

14 Sep 2021 |

Read More

PLI scheme for textiles: Rs 10,683 crore scheme to help MSMEs invest, ...

8 Sep 2021 |

Read More

Union Cabinet approves Rs 10,683-crore PLI scheme for textile sector

9 Sep 2021 |

Read More

Exporters unhappy with tax rebate rates under government's RoDTEP scheme

18 Aug 2021 |

Read More

New duty remission scheme to cover 8,555 items at an outlay of ...

18 Aug 2021 |

Read More

Govt announces RoDTEP rates for exporters; outlay Rs 12,454 cr in FY22

18 Aug 2021 |

Read More

RoDTEP scheme : Govt announces Rs. 12,400 crore outlay for tax refund ...

17 Aug 2021 |

Read More

Remission of Duties & Taxes on Export product

18 Aug 2021 |

Read More

Auto sector fears higher GST rate on certain parts after Supreme Court ...

16 Aug 2021 |

Read More

Hon’ble Delhi High Court Decision In Petitions Filed By Importers/Exporters Seeking Waiver ...

17 Aug 2021 |

Read More

Analysing the Contours of UN Tax Solution

12 Aug 2021 |

Read More

Country of origin’ crackdown continues

11 Aug 2021 |

Read More

Tax Newsletter – July 2021

11 Aug 2021 |

Read More

Withdrawal of retrospective indirect transfer amendment

9 Aug 2021 |

Read More

Intra Company Supplies – The Undefined Issue under GST

9 Aug 2021 |

Read More

Taxation of Virtual Currencies in India: an Insight

19 Jul 2021 |

Read More

Digital Taxes | Uncertainty shrouds India’s equalisation levy

14 Jul 2021 |

Read More

All expenditure of VC Funds including Carried Interest to carry GST - ...

14 Jul 2021 |

Read More

Slashed GST rates on COVID-related items: The stakeholder view

12 Jul 2021 |

Read More

Tax Newsletter: June 2021

7 Jul 2021 |

Read More

India’s Consumer Protection Rules: What Foreign E-Commerce Entities Need To Be Cognisant ...

29 Jun 2021 |

Read More

The UN’s recent step to kickstart Global Taxation of the Digital Economy

23 Jun 2021 |

Read More

The IFSC Framework: How can funds benefit?

24 Jun 2021 |

Read More

RoDETP hits a roadbump

5 Jun 2021 |

Read More

ELP Update on Integrated Goods and Services Tax Act, 2017

21 Jun 2021 |

Read More

Taxation of the Digitalized Economy

15 Jun 2021 |

Read More

Tax Newsletter - May 2021

4 Jun 2021 |

Read More

Implementing HSN 2022 - The countdown begins

26 May 2021 |

Read More

GST Considerations vis-à-vis CSR Expenditure

24 May 2021 |

Read More

Classification of Parts & Accessories - A Conundrum in the Waiting

31 May 2021 |

Read More

GST Update – Recommendations of 43rd GST Council Meeting

30 May 2021 |

Read More

Interest on delayed payment of consideration qua imported goods, subject to GST?

28 May 2021 |

Read More

When “shall” can be read as directory in Tax Statutes

22 May 2021 |

Read More

The Never Ending Classification Syndrome

12 May 2021 |

Read More

Tax Newsletter March 15-March 2021

15 Mar 2021 |

Read More

Tax Newsletter April 2021

30 Apr 2021 |

Read More

ELP - Bloomberg Quint - GST Anti-Profiteering: The Methodology Conundrum

27 Apr 2021 |

Read More

ELP - Knowledge Series – Part 1 of 2021

27 Apr 2021 |

Read More

Taxation is too taxing for the subcontractors

14 Apr 2021 |

Read More

Taxes on employee perquisites & emoluments – A match not made in ...

13 Apr 2021 |

Read More

Battle over Interest Intensifies

19 Feb 2020 |

Read More

Refund of input services under Inverted Duty Structure - Is the HC ...

6 Aug 2020 |

Read More

GST Enigma Around SEZ Transactions Continues?

23 Sep 2020 |

Read More

A Curious Case of ‘Cess’

20 Oct 2020 |

Read More

Tax Newsletter – March 15 – 31, 2021

15 Mar 2021 |

Read More

Finance Act 2021- A Glimpse into the Future of Indirect Tax Disputes

7 Apr 2021 |

Read More

Tax Newsletter – February 15 – 28, 2021

15 Mar 2021 |

Read More

Payment for use of computer software is of shrink-wrapped software not royalty

8 Mar 2021 |

Read More

Equalization Levy: The Ambiguity Continues To Exist

22 Feb 2021 |

Read More

Tax Newsletter – February 1 – 15, 2021

15 Feb 2021 |

Read More

Navigating GST – Issue 10

20 Feb 2021 |

Read More

Unsettling a settled tax dispute resolution structure

12 Feb 2021 |

Read More

New Law on Re-assessment – Critical to Define “Information"

12 Feb 2021 |

Read More

One Nation Many Cesses! – Now Agriculture Infrastructure And Development Cess

10 Feb 2021 |

Read More

Budget 2021 - Balancing Expectations and Reality

10 Feb 2021 |

Read More

Loss of goodwill in M&A forever

8 Feb 2021 |

Read More

Taxing the untaxed - Slump Exchange

8 Feb 2021 |

Read More

Filtering tools for incentivizing exports: Rebate down, more to go?

6 Feb 2021 |

Read More

Demystifying the Budget for Exporters

6 Feb 2021 |

Read More

Transgenerational Wealth – Estate and Succession Planning

5 Feb 2021 |

Read More

The centerpiece of Budget 2021 - Aatmanirbhar Bharat

5 Feb 2021 |

Read More

Underlying Theme of the Union Budget 2021 - Digitalization and Ease of ...

4 Feb 2021 |

Read More

Budget 2021-22: Towards an Agile Indian Tax System

6 Feb 2021 |

Read More

India’s Customs Tariff Policy: Clear, Unambiguous and Truly Evolved

9 Feb 2021 |

Read More

Why did the market go euphoric over Budget?

4 Feb 2021 |

Read More

Alcohol Prices Won't Increase due to 100% Agri Infra Cess

3 Feb 2021 |

Read More

Sensex surges post budget: what fueled it?

3 Feb 2021 |

Read More

Higher capital spends and no change in status quo for tax

3 Feb 2021 |

Read More

Retrospective Amendment under Section 7 of CGST Act

3 Feb 2021 |

Read More

Budget 2021: Amendment to DICGC Act

3 Feb 2021 |

Read More

Budget 2021: Re-emphasis on 13 sectors

3 Feb 2021 |

Read More

Mega Investment Textile Park

3 Feb 2021 |

Read More

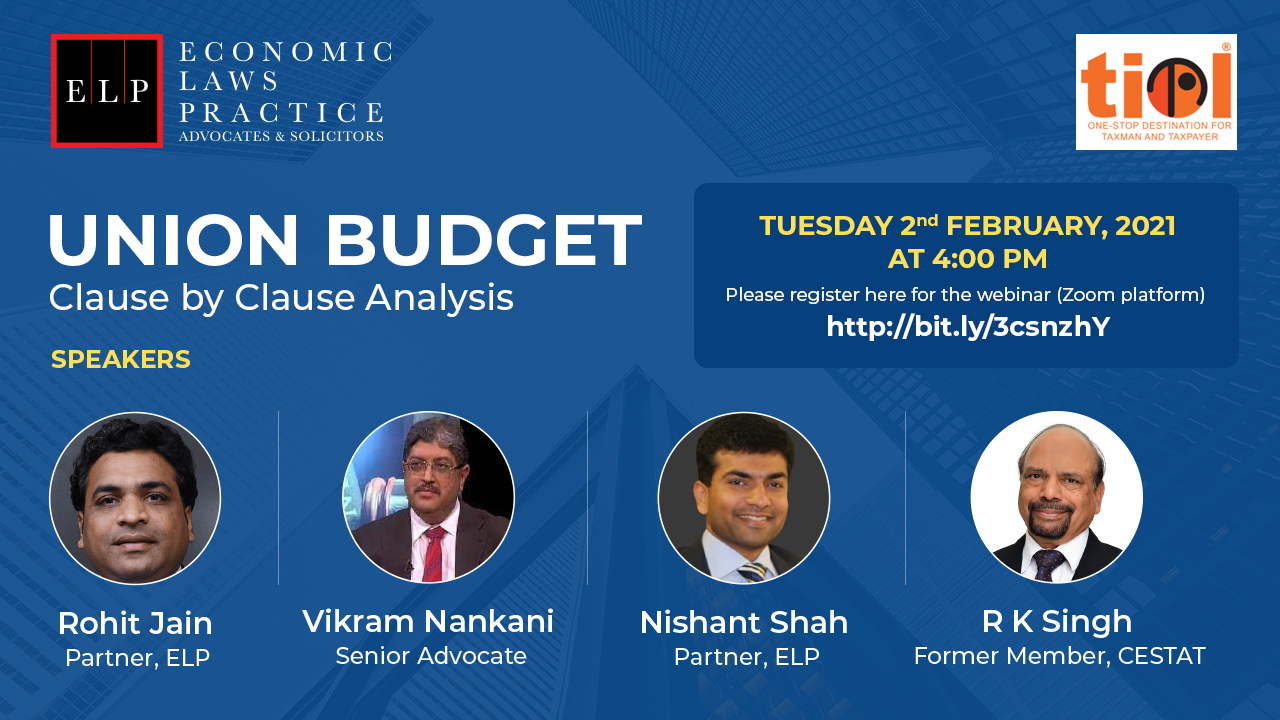

Rohit Jain on Union Budget 2021

3 Feb 2021 |

Read More

Budget 2021: Finance Minister offers stability in tax regime even as India ...

3 Feb 2021 |

Read More

Union Budget: Clause by Clause Analysis

2 Feb 2021 |

Read More

Union Budget 2021: An Analysis

2 Feb 2021 |

Read More

The Budget Buzz Make in India

1 Feb 2021 |

Read More

The Budget Buzz - Customs Tariff Measures

1 Feb 2021 |

Read More

Budget -Dispute Resolution

1 Feb 2021 |

Read More

Budget Buzz - Depreciation on Goodwill

1 Feb 2021 |

Read More

Deep Dive on the Union Budget 2021-2022 with ELP and PWC

30 Jan 2021 |

Read More

India Union Budget 2021: Analysis of Tax, Customs and Regulatory amendments

30 Jan 2021 |

Read More

Indirect Taxes on Safeguard Clauses in a Contract: Riddle Wrapped in an ...

30 Jan 2021 |

Read More

GST: Lessons from the past and the road ahead

13 Jan 2021 |

Read More

The Direct Tax Vivad Se Vishwas Act, 2020

14 Dec 2020 |

Read More

Tax Newsletter – November 16 – 30, 2020

9 Dec 2020 |

Read More

Navigating GST - Issue 9

2 Dec 2020 |

Read More

Tax Newsletter - November 1-15 2020

24 Nov 2020 |

Read More

Tax Newsletter: October 15- October 30

11 Nov 2020 |

Read More

Revised Import Norms for Trade Pacts

10 Nov 2020 |

Read More

Tax Newsletter – September 30 - October 15, 2020

22 Oct 2020 |

Read More

ELP – Tax Newsletter -September 15 – September 30

7 Oct 2020 |

Read More

Inverted Decision on Inverted Rate Structure

1 Oct 2020 |

Read More

Guidelines under Section 194-O and 206C(1H) of the IT Act

1 Oct 2020 |

Read More

Tax Collection at Source

29 Sep 2020 |

Read More

Navigating GST 2.0 – Issue 8

24 Sep 2020 |

Read More

Taxation & Other Laws (Relaxation & Amendment of Certain Provisions) Bill, 2020

22 Sep 2020 |

Read More

ELP – Tax Newsletter – August 15 to August 31

4 Sep 2020 |

Read More

ELP - Tax Newsletter - August 1 to August 15

20 Aug 2020 |

Read More

VKC Footsteps vs UOI Ors

7 Aug 2020 |

Read More

GST Implications on Royalty: A Continuum of Perspectives

31 Jul 2020 |

Read More

Navigating GST 2.0 – Issue 7

17 Jul 2020 |

Read More

Tax Newsletter - July 1 to 15 2020

16 Jul 2020 |

Read More

The Curious Case of ITC Admissibility

8 Jul 2020 |

Read More

Managing GST 2.0 - Issue 6

25 May 2020 |

Read More

Burning Issues Plaguing the GST Refunds

11 May 2020 |

Read More

Equalization Levy 2.0: Uncertainities Abound

5 May 2020 |

Read More

Unraveling the Dichotomy of GST on Director's Remuneration

15 May 2020 |

Read More

Director's remuneration: Is GST applicable across the board?

16 Apr 2020 |

Read More

Rules 86A(1)(B) of the CGST Rules - The Saga of Blocked Credit

14 Apr 2020 |

Read More

RoDTEP- A Silver Lining for Indian Exporters

13 Apr 2020 |

Read More

Navigating GST 2.0 : Issue 4

25 Apr 2024 |

Read More

Retrospective Amendment and Consequent Interest Liability in GST Legislation - An Analysis

11 Mar 2020 |

Read More

Tax Update (March 10 - March 31, 2020)

25 Apr 2024 |

Read More

Budget 2020- Widened Scope of Offences and Criminalization under GST Law

24 Mar 2020 |

Read More

Enhancing Insurance Coverage on Bank Deposits - Increasing Tax Litigation Woes for ...

18 Mar 2020 |

Read More

ELP - Tax Update (February 25 - March 10, 2020)

1 Mar 2020 |

Read More

Settling the Unsettled Concept of Job Work

6 Mar 2020 |

Read More

ELP - Export Control Alert

21 Feb 2020 |

Read More

Tightening the Ropes on Administration of Preferential Tariff Treatment under Trade Agreements

13 Feb 2020 |

Read More

ELP -Taxation Update - The Direct Tax Vivad Se Vishwas Bill 2020

12 Feb 2020 |

Read More

India’s new rules to tax “stateless” NRIs lack clarity and may hit ...

5 Feb 2020 |

Read More

Union Budget 2020: An Analysis

2 Feb 2020 |

Read More

ELP - Knowledge Series - India Update - Part 4 of 2019

22 Jan 2020 |

Read More

New Consumer Protection Act: Why businesses need to be prepared for greater ...

17 Jan 2020 |

Read More

Anti-Profiteering Whip To The Real Estate Sector

18 Jan 2020 |

Read More

Tax Audits for enterprises that claim GST refunds illicitly

13 Jan 2020 |

Read More

Navigating GST 2.0 : Issue 2

4 Dec 2019 |

Read More

Taxation in India: Curated Views

22 Nov 2019 |

Read More

Tax department wants to impose 18% GST on CXO salaries

22 Nov 2019 |

Read More

The Incongruity between Income Tax and GST Laws

22 Nov 2019 |

Read More

Realtors told to reverse transition credit

22 Nov 2019 |

Read More

GSTsutra Expert Column: Interplay of Goods And Services Tax Laws Vis-a-Vis Customs ...

12 Nov 2019 |

Read More

New income-tax amendments by the Finance Ministry to boost the economy

24 Oct 2019 |

Read More

ELP - Knowledge Series - India Update - Part 3 of 2019

3 Sep 2019 |

Read More

Anti-profiteering Authority sends notices to HUL, P&G and other FMCG Cos

28 Aug 2019 |

Read More

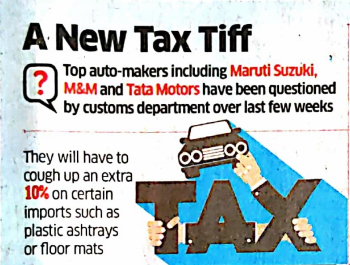

It's Plastic, but for Taxman it's Auto Part & Higher Tax

26 Aug 2019 |

Read More

FMCG, pharma cos to contest retro tax

26 Aug 2019 |

Read More

The new Consumer Protection Bill - What's in store?

26 Aug 2019 |

Read More

Taxsutra & ELP Present Webinar on 'GST Proposals and Legacy Dispute Resolution ...

10 Jul 2019 |

Read More

Union Budget 2019 - An Analysis

7 Jul 2019 |

Read More

GST implications on transactions in securities- Part 1

11 Jun 2019 |

Read More

ELP Knowledge Series - India Update Part 2 of 2019

7 May 2019 |

Read More

Export Control Update: Amendments in the SCOMET List

5 May 2019 |

Read More

Interpretation of exemption notifications in fiscal statutes

8 Apr 2019 |

Read More

The Real Estate Sector: Finally Witnessing Its Silver Lining?

25 Mar 2019 |

Read More

ELP Rohit Jain on BTVI News GST Council Post Discussion

28 Feb 2019 |

Read More

Unsold flats to see demand

25 Feb 2019 |

Read More

Relief to start-up companies from Angel Tax - DPIIT issues notification to ...

21 Feb 2019 |

Read More

ELP Knowledge Series - India Update Part 1 of 2019

19 Feb 2019 |

Read More

A look at the Pre-Import condition under GST regime

12 Feb 2019 |

Read More

Package Scheme of Incentives in Maharashtra – Is it actually incentivizing?

15 Feb 2019 |

Read More

A year later, uncertainties on GST implementation mar realty sector

1 Jul 2018 |

Read More

Budget 2019: Judicial Reform Is What This Economy Needs Now

2 Feb 2019 |

Read More

Interim Union Budget 2019 - An Analysis

1 Feb 2019 |

Read More

ELP's Harsh Shah - Zee Business

14 Jan 2019 |

Read More

ELP's Anay Banhatti- Zee Business

15 Jan 2019 |

Read More

Taxsutra Webinar Invitation

22 Nov 2018 |

Read More

Can salary paid for services by head office to its branch offices ...

15 Sep 2018 |

Read More

Mechanism of Audit by tax authorities under GST laws

7 Sep 2018 |

Read More

ELP Knowledge Series - India Update Part 2 of 2018

10 Sep 2018 |

Read More

Circular dated 08.06.2018 on servicing of cars may open a pandoras box ...

25 Jun 2018 |

Read More

The Anti-profiteering conundrum

20 Jul 2018 |

Read More

Taxation of import of services – The series of sharp U-turns

5 Dec 2016 |

Read More

GST Weekly Update Compilation

15 Sep 2017 |

Read More

Budget walks the tightrope with fewer changes to tax structure

1 Feb 2018 |

Read More

Putting the real back in realty

14 Feb 2018 |

Read More

Anti-profiteering provisions under GST: Analysing the emerging paradigm

25 Apr 2024 |

Read More

ELP Tax Alert: ITAT upholds internet domain registration receipts taxable as royalty

12 Apr 2018 |

Read More

ELP Tax Alert: SC upholds waiver of loan acquired for capital purposes ...

16 May 2018 |

Read More

ELP Tax Alert - Flipkart India Private Limited

18 May 2018 |

Read More

ELP Tax Alert: Supreme Court upholds disallowance of expenditure under Section 14A ...

21 Mar 2018 |

Read More

ELP Knowledge Series - India Update Part 1 of 2018

14 Jun 2018 |

Read More

Rohit Jain

Rohit Jain

Nishant Shah

Nishant Shah

Harsh Shah

Harsh Shah

Jitendra Motwani

Jitendra Motwani

Kumar Visalaksh

Kumar Visalaksh

Gopal Mundhra

Gopal Mundhra

Stella Joseph

Stella Joseph

Jignesh Ghelani

Jignesh Ghelani

Mitesh Jain

Mitesh Jain

Vivek Baj

Vivek Baj

Adarsh Somani

Adarsh Somani

Darshan Bora

Darshan Bora

Rahul Charkha

Rahul Charkha

Tejus Pathak

Tejus Pathak

Gourav Sogani

Gourav Sogani

Rahul Khurana

Rahul Khurana

Sweta Rajan

Sweta Rajan

Ginita Bodani

Ginita Bodani

Mohammad Asif Mansoory

Mohammad Asif Mansoory

Varun Parmar

Varun Parmar

Parth Parikh

Parth Parikh

Krutika Kale

Krutika Kale

Sahil Kothari

Sahil Kothari

Ruchita Shah

Ruchita Shah

Sumeet Agrawal

Sumeet Agrawal

Supreme Kothari

Supreme Kothari

Sachin Jain

Sachin Jain