Adarsh is a Tax partner at Economic Laws Practice and specializes in the areas of GST, customs & trade, with expertise in strategic transaction advisory and policy matters.

Adarsh has over 15 years of experience in advising multinationals and Indian conglomerates on a wide range of matters relating to tax efficient business organization & re-organizations and cross-border structuring. Adarsh has been closely involved in several marquee transactions and has extensive experience in advising multinational and domestic companies in deploying tax efficient value chains in business.

Adarsh has been advising clients on various indirect tax legislations including GST, Customs, Foreign Trade Policy, Export Control as well as erstwhile service tax, excise duty & Value Added Tax across a wide range of industries, including the FMCG, Financial services, Manufacturing and Media & Entertainment industries. Adarsh has assisted clients in several high-profile tax litigations and is actively sought out by multinationals and domestic firms for tax controversy and regulatory policy matters.

Adarsh has also been involved in assignments for establishing greenfield projects in India, and has assisted in India entry strategies, finalizing business plans and negotiating with state and Central government agencies for investment incentives.

Adarsh holds an LL.B degree and is also a qualified Chartered Accountant.

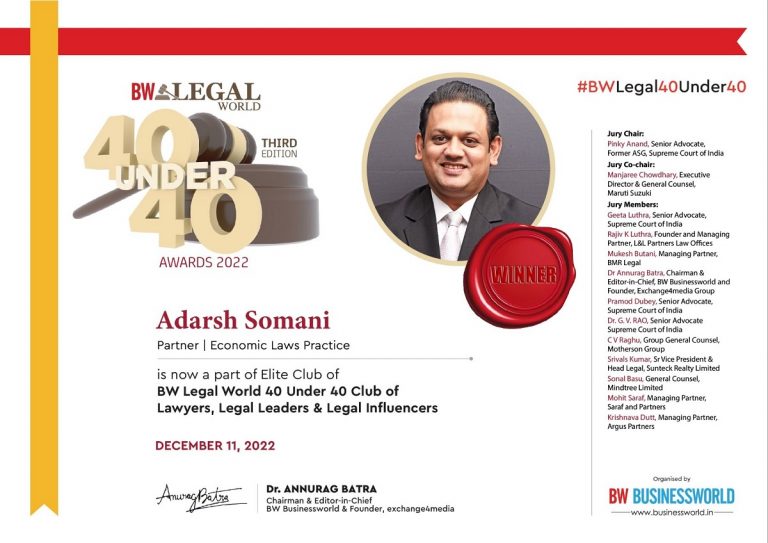

Adarsh has been recognized in Business World’s elite 40 Under 40 Club of Young Law Achievers. He is also recognized as recommended for Tax and Life Sciences and Healthcare by The Legal 500 Asia-Pacific. Adarsh has been recognized in Asian Legal Business’s India Super 50 Lawyers List.

He regularly speaks at tax & regulatory conventions and has authored several articles and thought papers in leading publications.

Prior to joining ELP, Adarsh has worked at BMR Advisors and Ernst & Young.

Newsletter/Booklets 23rd Jul 2024

Union Budget 2024-25 – An Analysis by Economic Laws Practice

READ MORE

Alerts & Updates 17th Jul 2024

Rate Notifications and Circulars issued by the Central Board of Indirect Taxes and Customs (‘CBIC’)

READ MORE

Alerts & Updates 12th Jul 2024

Notifications and Circulars issued by Central Board of Indirect Taxes and Customs (‘CBIC’)

READ MORE

Tax

Tax