Alerts & Updates 22nd Mar 2024

As part of its continuous efforts to promote the Electric Vehicle (EV) sector in India, the Indian government unveiled a scheme i.e., “Scheme to Promote Manufacturing of Electric Passenger Cars in India” (Scheme) last week. According to the Indian government, this Scheme is expected to encourage investments in India, generate employment, and promote the “Make in India” campaign by fostering domestic manufacturing capabilities in the EV sector.[1]

This note provides a high-level overview of the Scheme, along with a snapshot of India’s import and export performance in electric passenger cars i.e., electric four-wheelers (e-4W), key considerations arising out of the implementation of the Scheme as well as the pivotal role the Scheme may play towards sustainable mobility and India’s competitiveness in the global market.

The Scheme aims to attract investment from global EV manufacturers and promote EV manufacturing in India. To achieve this objective, the Scheme offers certain benefits to certain companies subject to fulfilling certain criteria.

Eligibility Criteria to Qualify for Benefits:

Eligibility Criteria for Availing Benefits:

Benefits Offered:

|

* According to the Scheme, a “Group Company(ies) shall mean two or more enterprises which, directly or indirectly, are in a position to: Exercise twenty-six percent or more of voting rights in the other enterprise;”

It is pertinent to note that, while imports are capped at 8,000 e-4W per year, the maximum number of e-4W (with a minimum CIF value of 35,000 USD) that can be imported at a 15% duty rate is contingent on the lower of the following:

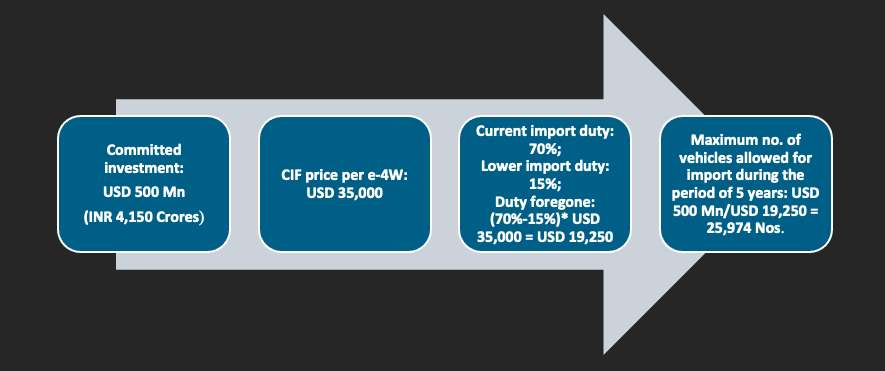

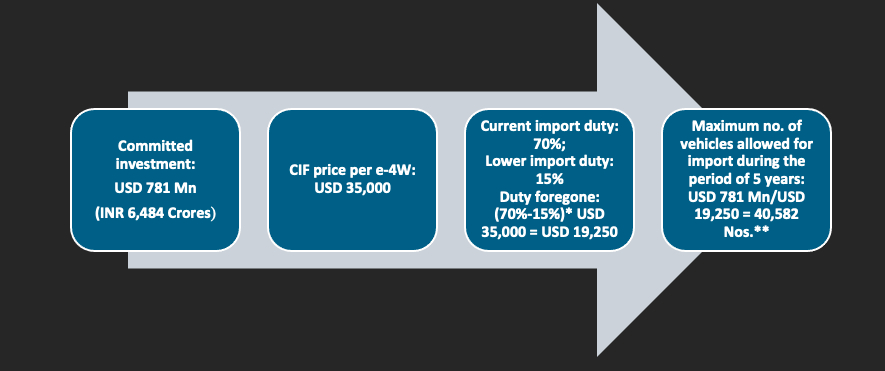

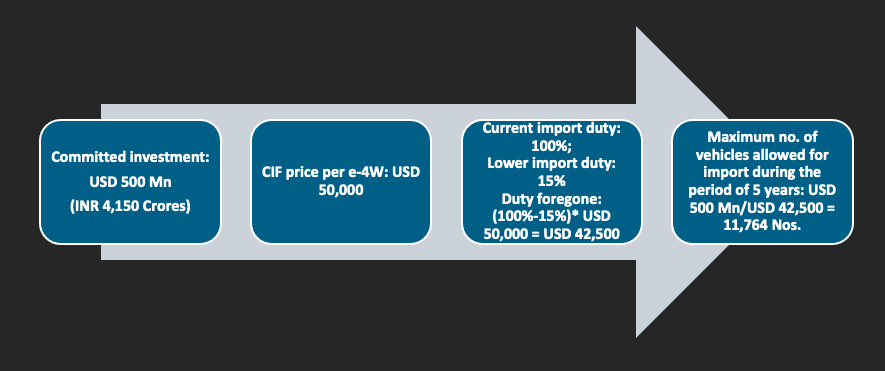

Given the complexity involved in ascertaining the maximum number of e-4W that can be imported at a lower duty rate of 15%, the Scheme itself has set forth a few illustrations – the same are reproduced below.

** Given that the imports of 2-4W are capped at 8000 per year, the maximum number of EVs that can be imported within a period of five years would be 40,000 Nos. as opposed to 40,582 Nos.

Additionally, the Scheme sets forth modalities for filing applications, details of the implementing agency and their obligations thereof to assess the progress and performance of the applicant, and the approval process under the Scheme to avail lower customs duties. Notably, certain consequences are also set forth for any misrepresentation or non-fulfillment of investment commitments among others. For example:

– Minimum investment of INR 4,150 crore (~ USD 500 Mn) within 3 years;

– DVA of a minimum of 25% within 3 years at the applicant’s manufacturing facility;

– Investment made within 5 years should be at least equivalent to duty foregone, or USD INR 4,150 crore (~ USD 500 Mn), whichever is more;

– DVA of a minimum of 50% within 5 years at the applicant’s manufacturing facility.

The MHI has indicated that certain additional guidelines for implementing this Scheme will be issued. Furthermore, the modalities of the Scheme as they currently stand may be reviewed and revised by the Indian government from time to time.

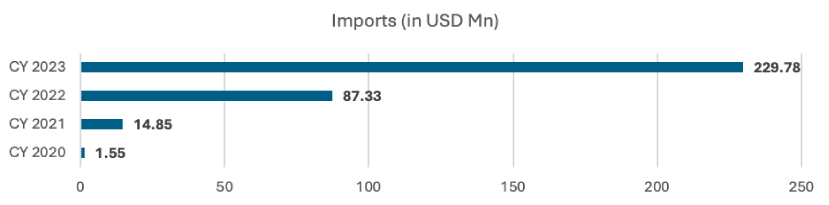

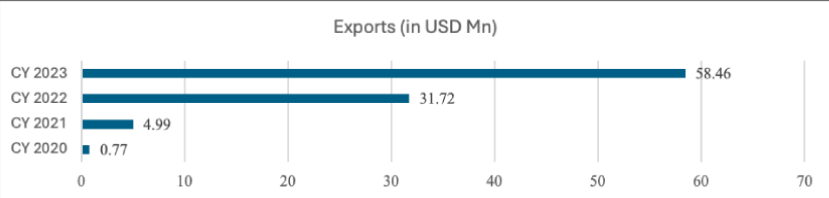

India is currently a net importer of e-4W i.e., EV passenger cars. In CY 2023, India’s imports[2] were valued at USD 230 Mn vis-a-vis exports[3] which were valued at USD 58.46 Mn.

Source: Tradestat, Ministry of Commerce, Government of India.

CY = Calendar Year

Source: Tradestat, Ministry of Commerce, Government of India.

CY = Calendar Year

Indian Exports of EV Passenger Cars

Source: Tradestat, Ministry of Commerce, Government of India.

CY = Calendar Year

That said, India’s imports have expanded from USD 1.55 Mn in CY 2020 to about USD 230 Mn in CY 2023 – which is a 14800% increase in imports. India’s exports on the other hand expanded from USD 0.77 Mn in CY 2020 to USD 58.46 Mn in CY 2023. In other words, the imports and exports have risen in the last few years signalling strong demand in the EV sector in India as well as globally. Indeed, according to NITI Aayog[4], overall EV adoption rates are expected to reach 10-12% by FY 26 and 30-35% by FY 30 in India.

Additionally, as regards the global EV market, India has a small footprint. Basis the ITC Trademap data (available as of 2022),[5] the global EV trade across all categories of EVs[6] was valued at about USD 94 billion and India’s trade constituted only 0.001% of global trade. That said, given the worldwide increase in trade in EVs in the last few years, there is a rampant demand for EVs.

The Scheme signifies a strategic move aimed at bolstering domestic production and enhancing competitiveness in the domestic market and also indicates India’s willingness to adapt to evolving global trade dynamics and capitalize on emerging opportunities in the EV sector. Indeed, the Scheme represents a departure from India’s historical hesitation in liberalizing tariffs on passenger cars/ automobiles. Needless to say, the Scheme presents an opportunity for India to lead the global transition from traditional Internal Combustion Engine (ICE) powertrains to more efficient and eco-friendly EV technology.[7] Further, the potential influx of global manufacturers is likely to increase competition in the domestic market leading to an increase in quality, choices, and innovation at competitive prices while at the same time meeting the goals of climate change and less dependence on fossil fuels and import bills.

Businesses looking to benefit from the Scheme should also take note of the treatment of investments originating in border countries, particularly China. While Foreign Direct Investment (FDI) in automobiles is under the automatic route, investments from such countries require specific approval from India’s Ministry of Home Affairs.[8] Furthermore, under the Scheme, investments from China would be subject to MHI’s approval adding a layer of approval requirements.

The success of the Scheme would also depend upon its objective implementation and certainty:

First, the Scheme appears to benefit certain companies upon meeting certain criteria, thereby paving the way for such companies to set up manufacturing facilities to capture consumer choices. This conditional liberalization of tariff available to companies that meet additional criteria of committed investment into India may raise questions concerning WTO compatibility, particularly with the Most Favoured Nation principle.

Second, investors could be wary of a possible dispute with the Indian government in the future in light of the government’s recent dispute with E-scooter makers where the government claimed a refund of subsidies on account of an alleged violation of localization requirements. Therefore, it is imperative that the government implements the Scheme transparently and objectively and that investors comply with all conditions in letter and spirit.

We trust you will find this an interesting read. For any queries or comments on this update, please feel free to contact us at insights@elp-in.com or write to our authors:

Sanjay Notani, Partner, Email – SanjayNotani@elp-in.com

Parthsarathi Jha, Partner, Email – ParthJha@elp-in.com

Harika Bakaraju, Principal Associate, Email – HarikaBakaraju@elp-in.com

Mitul Kaushal, Consultant, Email – MitulKaushal@elp-in.com

Shweta Kushe, Associate, Email – ShwetaKushe@elp-in.com

[1] Ministry of Heavy Industries, Notification no. S.O. 1363(E). – Scheme to Promote Manufacturing of Electric Passenger Cars in India, dated 15 March 2024.

[2] India has imported largely from Germany, followed by Sweden, Korea RP, China PR, UK, and USA among others.

[3] India’s exports were made to Nepal, France, Germany, Korea, Australia, and Vietnam among others.

[4] NITI Aayog-BCG-ADB report on “Promoting Clean Energy Usage Through Accelerated Localization of E-Mobility Value Chain”, May 2022.

[5] ITC Trademap data for HS 870380.

[6] HS 870380 – Motor cars and other motor vehicles principally designed for the transport of <10 persons, incl. station wagons and racing cars, with only electric motor for propulsion (excl. vehicles for travelling on snow and other specially designed vehicles of subheading 8703.10).

[7] Ministry of Heavy Industries, Notification no. S.O. 1363(E). – Scheme to Promote Manufacturing of Electric Passenger Cars in India, dated 15 March 2024.

[8] Ministry of Commerce & Industry’s Press note no. 3 (2020 series) concerning the Review of FDI policy for border countries.