Alerts & Updates 19th Jan 2023

Drawing from the results and experience of the resolution process of many listed companies under the provisions of the Insolvency and Bankruptcy Code, 2016 (IBC/the Code), and considering the fate of public shareholders under such resolutions, SEBI issued a consultative paper on November 10, 2022(Proposed Framework). This framework introduces proposals to ensure participation of public shareholders in a Company getting resolved by way of Corporate Insolvency Resolution Process of the Corporate Debtor (CIRP) under the Code.

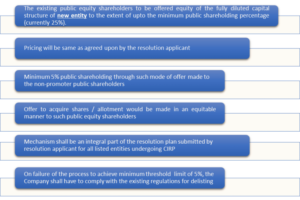

The proposed participation of public shareholders of the Corporate Debtor or the resultant entity will be by way of issuance of fresh equity shares to the existing public shareholders against value. The proposals, therefore, cannot be termed as protection of interest of public shareholders. Rather, it is in the form of conditionality for the Corporate Debtor if the resolution applicant wishes to maintain the Corporate Debtor as a listed company.

The exemptions granted under the SEBI (Delisting of Equity Shares) Regulations, 2021 for the purpose of IBC is proposed to be reviewed and exemption from provisions of Delisting Regulations shall be available only availed where:

The argument in support of the above proposal is that through this method the Company will be able to retain its status as a listed company with a minimum public float post restructuring. Also, the burden on successful bidder/ resolution applicant will be lesser as capital for part equity in the new entity can be met through an offer to non-promoter public shareholders. The Resolution applicant shall have this additional source of raising money and simultaneously shall also comply with minimum public shareholding norms. Existing public shareholders of the company under CIRP become shareholders in the company post restructuring. Existing public shareholders will have the opportunity to acquire capital of the new entity at the same cost as the new acquirer..

As submitted earlier, the proposal can hardly be said to be a protection mechanism as it does not guarantee any return for investment already made by the existing shareholders. It is also important to bear in mind that the new equity will be against new value.

Second, the concern of the regulation is not in line with the basic rules governing equity – even if it is by way of investment. The basic nature of equity as against debt, is participation in future opportunities of the business along with its related risk. Price is determined based on the valuation of the Company, its performance and market conditions and its prospects. Entry and exit mostly at the will of the investor. In the case of the investor, the arrangements are usually backed by buy back obligations of the promoters at pre-determined value. Thus, an investor or say informed investor will have ample option to exit in light of the financial health and operations of the Company. On the other hand, credit is on pre agreed terms and return is not linked to performance of the Company. Once credit is provided to the Company by a lender, there is very little option to exit except by way of novation or assignment. Recall of the facility too does not guarantee immediate return of the finance.

The nature of the two transactions being entirely different, the two must be allowed to operate accordingly. There is a strong case for investor education for public shareholders and strengthening control and disclosure norms rather than tinkering with the already complicated resolution process which is already otherwise marred with uncalled for and multifarious litigations. Involvement of public at the stage of resolution is neither feasible nor practical and may lead to uncalled for litigations challenging valuations model, terms of the plan and offer itself.

Further, there is no need to bring in the concept of section 230 of the Companies Act, 2013 into the resolution process under IBC, which exist independently and can be utilized by the parties as per the need and situation. The Hon’ble Supreme Court in the case of Jaypee Kensington Boulevard Apartments Welfare Association vs NBCC (India) Ltd & Ors[ii], has amply clarified that “in the scheme of IBC, only the CoC is entrusted with the task of dealing with and approving the plan of insolvency resolution; and the shareholders of a corporate debtor, who is already reeling under debts, have not been provided any participation in the insolvency resolution process. It goes without saying that in the case of a corporate debtor like JIL, if the process of liquidation is resorted to under Chapter III of the Code, there is a very little likelihood of the shareholders getting even dewdrops out of the waterfall of distribution of assets, as delineated in Section 53 of the Code, where the preference shareholders and equity shareholders stand last in the order of priority. ……… In any case, a decision in regard to the aforesaid step in the resolution plan had been that of the commercial wisdom of the Committee of Creditors and is not amenable to judicial review”. (Emphasis added)

It was further observed by the Hon’ble Court that “Reference to Section 230 of the Companies Act, 2013, which deals with power to compromise or make arrangements with creditors and members is entirely inapt in the context of the present case because no such proceedings for compromise or arrangements are in contemplation. On the contrary, in the present case, the proceedings of CIRP under the Code have reached an advanced stage with approval of resolution plan by the CoC and the Adjudicating Authority.” (Emphasis added)

In another judgement[iii] the Hon’ble Supreme Court has observed that “ultimately, the interests of all stakeholders are looked after as the corporate debtor itself becomes a beneficiary of the resolution scheme—workers are paid, the creditors in the long run will be repaid in full, and shareholders/investors are able to maximise their investment. Timely resolution of a corporate debtor who is in the red, by an effective legal framework, would go a long way to support the development of credit markets. Since more investment can be made with funds that have come back into the economy, business then eases up, which leads, overall, to higher economic growth and development of the Indian economy.” (Emphasis added)

While both equity and debt are equally important for business, but both should operate in their respective field as per the terms and conditions and the Regulator should not attempt anything which may result in creating a conflicting situation especially in the light of the very scheme enshrined under IBC structure. Any interference with the present regime of IBC is not required in the light of settled position of the law that in an insolvency situation, it is interest of the creditor which needs to be protected (and are in fact protected in all the major jurisdictions) rather than that of shareholders as they directly or indirectly have a role in managing the affairs of the Company. The existing mechanism under the Companies Act, 2013[iv] also provides for acquisition of shares by a company from dissenting shareholders in a conflicting situation.

| In view of this, it would be essential if the following factors are considered for the Proposed Framework by SEBI: | |

| Keep into Consideration the Scheme Under IBC |

|

| Framework to apply only if CD to remain a listed Company under the Resolution Plan |

|

| Exemption provided by 2018 Amendment to remain available |

|

| Public offer process to be effective after approval of plan and not as part of implementation of the Plan |

|

| To take into account various options of restructuring |

|

| Liability of the Resolution Applicant to remain unaffected |

|

| 5% Public Holding not to be shown as sources of funding the Plan |

|

| Need to restrict right during stage of implementation of the resolution plan |

|

Key Takeaways:

|

|

We hope you have found this information useful. For any queries/clarifications please write to us at insights@elp-in.com or write to our authors:

Mukesh Chand, Senior Counsel – Email – MukeshChand@elp-in.com

Disclaimer: The information contained in this document is intended for informational purposes only and does not constitute legal opinion or advice. This document is not intended to address the circumstances of any individual or corporate body. Readers should not act on the information provided herein without appropriate professional advice after a thorough examination of the facts and circumstances of a situation. There can be no assurance that the judicial/quasi-judicial authorities may not take a position contrary to the views mentioned herein

[i] For identifying public equity shareholders, following category of shareholding (shares and shares underlying depository receipts) shall be excluded:

[ii] CIVIL APPEAL NO. 3395 OF 2020 Judgement dated 24th March, 2021[the resolution plan provides an exit option to existing public shareholders at a price which is higher of the liquidation value (as applied in the order of priority of claims prescribed under Section 53 of IBC) and the exit price being paid to the promoters. In this regard, the Non-Promoter Shareholders (i.e. the public shareholders) shall be paid an exit price aggregating to INR 1 Cr and pursuant to the same, their shareholding shall be extinguished.]

[iii] ArcelorMittal [ArcelorMittal (India) (P) Ltd. v. Satish Kumar Gupta, (2019) 2 SCC 1]

[iv] Section 395 of the Act of 1956, Section 235 of the Companies Act, 2013 provides for the acquisition of shares by a company from the dissenting shareholders by way of a scheme or contract which has been approved by the majority of shareholders. Notification dated 3 February 2020, introduced a new method for acquisition of shares of the minority by unlisted companies.

Section 230(11)15 read with Rule 3(5) and (6) of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 allow the majority of shareholders, holding at least 3/4th of the shares, to make an offer to acquire the remaining shares by making an application before the National Company Law Tribunal. Rule 80A provide for the report of a registered valuer shall be submitted along with the application, thereby ensuring that the rights of the minority are protected at all costs. Section 230 (12) of the Companies Act, 2013 provides for remedy where a party is aggrieved by the takeover offer.

[v] Regulation 37 of CIRP Regulations, 2018 provide that:

A resolution plan shall provide for the measures, as may be necessary, for insolvency resolution of the corporate debtor for maximization of value of its assets, including but not limited to the following: –

(a) transfer of all or part of the assets of the corporate debtor to one or more persons;

(b) sale of all or part of the assets whether subject to any security interest or not;

(ba) restructuring of the corporate debtor, by way of merger, amalgamation and demerger;

(c) the substantial acquisition of shares of the corporate debtor, or the merger or consolidation of the corporate debtor with one or more persons;

(ca)cancellation or delisting of any shares of the corporate debtor, if applicable;

(d) satisfaction or modification of any security interest;

(e) curing or waiving of any breach of the terms of any debt due from the corporate debtor;

(f) reduction in the amount payable to the creditors;

(g) extension of a maturity date or a change in interest rate or other terms of a debt due from the corporate debtor;

(h) amendment of the constitutional documents of the corporate debtor;

(i) issuance of securities of the corporate debtor, for cash, property, securities, or in exchange for claims or interests, or other appropriate purpose;

(j) change in portfolio of goods or services produced or rendered by the corporate debtor; (k) change in technology used by the corporate debtor; and

(l) obtaining necessary approvals from the Central and State Governments and other authorities.

(m) sale of one or more assets of corporate debtor to one or more successful resolution applicants submitting resolution plans for such assets; and manner of dealing with remaining assets.