Overview

The Government has been gradually and steadily introducing policies and practices that will give the necessary and much needed fillip to the Indian Defence Industrial Base. Over the last few years this sector has continued to garner immense interest, primarily driven by a huge demand within India, from not only the Government of India and Governments overseas, but also relevant stakeholders. However, long-drawn teething issues, currently being faced by various stakeholders are an inherent part of this sector.

Aided with a team that is technically proficient and furthermore, has in-depth expertise in the defence sector, ELP aims to address these issues by offering comprehensive solutions to its clients. ELP’s proficiency lies in advising various multinational companies and firms on all issues of advisory and compliance in the sector ranging from Business Strategy Planning, transaction support across the lifecycle of a Program, Indian export control regulations, obtaining licences, support for Government advocacy for policy change, decoding the Defence Procurement Procedures to gain competitive advantage, M&A and Joint Venture (JV) consulting.

Services

Transaction Support

- Formulating Entry Strategies – Detailing the Business Plan (Focussed Markets, Investments, and Risks);

- Defence Business Valuation and Market Due Diligence;

- End-to-end M&A and JV Consulting – Ranging from identifying the right partner to forging partnerships;

- Decoding the Defence Procurement Procedure (DPP) and the Defence Production Policy (DPrP) to gain competitive advantage across Buy (IDDM, Indian), Buy & Make, Make and Strategic Partnership Categories;

- Optimising Winning solutions – including support during bidding – review of various bidding documents in the RFP/EoI phases in line with the applicable DPP provisions, tax laws and export control regulations;

- Driving Growth through Strategy and Tactical consulting (programme specific);

- Incorporation of special purpose vehicles, drafting of the constitutional documents and ancillary work;

- Drafting and vetting of Joint venture agreements, Collaboration agreement, Supply agreements, Technology Transfer and Technical Support Agreements, Intellectual property licence agreements, Confidentiality & Non-Disclosure Agreements and other ancillary agreements;

- Transaction Support which inter-alia, covers due diligence, negotiations, documentation

Taxation Optimisation and Structuring

- Inbound and outbound structuring;

- Treaty interpretations;

- Identifying tax efficient structure for supplies against export orders, offset orders and domestic supplies;

- Structuring and/or re-structuring for domestic and cross border supplies;

- Bid related assistance;

- Structuring of Revenue and/or capital flows – for example, dividend, royalty, fees for technical services;

- Advocacy support;

- Tax compliance & dispute assistance (litigation support)

Advocacy, Legal cum Commercial Review and Litigation Support

- Contract Review and Negotiation Support post bidding stage. Supply and procurement contracts of foreign bidders and/or partners and developing the risk matrix for the same. Contract review and risk matrix development for sub-supplier contracts;

- Drafting and Front-ending Policy Recommendations for Industry (Advocacy Support) and Policy documents for the Ministry of Defence;

- Joint Ventures and collaborations which would include due diligence of the Indian companies involved;

- Guidance on anti-bribery laws and international trade sanctions;

- Representation regarding import and export transactions and acquisitions of all kinds;

- Advising, strategising and representing our clients across fora, tribunals and courts from the inquiry & investigation stages right until the Supreme Court of India;

- Disputes and/or Dispute resolutions;

- Anti-bribery and corruption investigations including compliance checklists

Export and Regulatory Compliance Support

- Assisting companies in developing export compliance procedures and export management systems and procedure reviews;

- Drafting and vetting of Agreements to be export control compliant between parties;

- Guide companies through export controls due diligence in domestic and multinational transactions;

- Advisory on coverage under the regulations, and attendant compliances and/or procedures – this involves an analysis of the technical characteristics, end-use and/or end-user of the product, Customs HS codes, and precedents in terms of past license applications where available;

- Assistance with drafting, filing and follow up of applications and/or representations for clarification on coverage with the concerned Ministries and Departments;

- Assistance with applying for and obtaining export licences, where required, from the Directorate General of Foreign Trade(DGFT) and/or the concerned Ministry and Department;

- Review of business operations and transactions so as to identify risk areas (potential non-compliance) and suggest measures for risk mitigation;

- Preparation of Standard Operating Procedure, including checklists for compliance, identification of a broad approach for future risk assessment, outlining of decision process to be followed, and broad guidelines for supporting processes, including documentation and record keeping;

- Advice and assistance on policy initiatives and representations before Governmental authorities;

- Conduct internal training and draft manual on export compliance

Thought Leadership

Union Budget - An Analysis by Economic Laws Practice

1 Feb 2022 |

Read More

ELP Knowledge Series – Part 2 of 2021

15 Sep 2021 |

Read More

ELP - Knowledge Series – Part 1 of 2021

27 Apr 2021 |

Read More

Leasing in India: All you need to know

11 Feb 2021 |

Read More

Union Budget 2021: An Analysis

2 Feb 2021 |

Read More

Notification of new Defence Acquisition Procedure 2020

29 Sep 2020 |

Read More

FDI in Defence Sector - Upto 74% allowed under the automatic route

18 Sep 2020 |

Read More

Investing in INDIA's Defence Sector

9 Sep 2020 |

Read More

Investing in India's Defence Sector

28 Aug 2020 |

Read More

Embargo on import of 101 defence items

10 Aug 2020 |

Read More

Notification of Force Majeure Clause in Defence Contracts

18 Jun 2020 |

Read More

Revision to Public Procurement

9 Jun 2020 |

Read More

GST Deduction on MRO Services

30 Mar 2020 |

Read More

Notification regarding Legal Undertaking for Defence Exports

18 Feb 2020 |

Read More

Union Budget 2020: An Analysis

2 Feb 2020 |

Read More

ELP - Knowledge Series - India Update - Part 4 of 2019

22 Jan 2020 |

Read More

Framework for placing Long Term Orders for Indigenization by Defence PSUs and ...

26 Nov 2019 |

Read More

ELP- Quarterly update - Defence & aerospace

8 Nov 2019 |

Read More

ELP Defence and Aerospace policy update - Guidelines for use of Government ...

17 Sep 2019 |

Read More

ELP - Knowledge Series - India Update - Part 3 of 2019

3 Sep 2019 |

Read More

ELP- Quarterly update - Defence & aerospace

12 Jul 2019 |

Read More

India's Defence Exports More Than Double

1 May 2024 |

Read More

ELP Knowledge Series - India Update Part 2 of 2019

7 May 2019 |

Read More

What’s The Real Cost Of Rafale Purchase?

18 Mar 2019 |

Read More

India shows military might as it pushes for defence sector self-reliance

24 Feb 2019 |

Read More

ELP Knowledge Series - India Update Part 1 of 2019

19 Feb 2019 |

Read More

Implementation of Artificial Intelligence in Indian Defence Services

13 Feb 2019 |

Read More

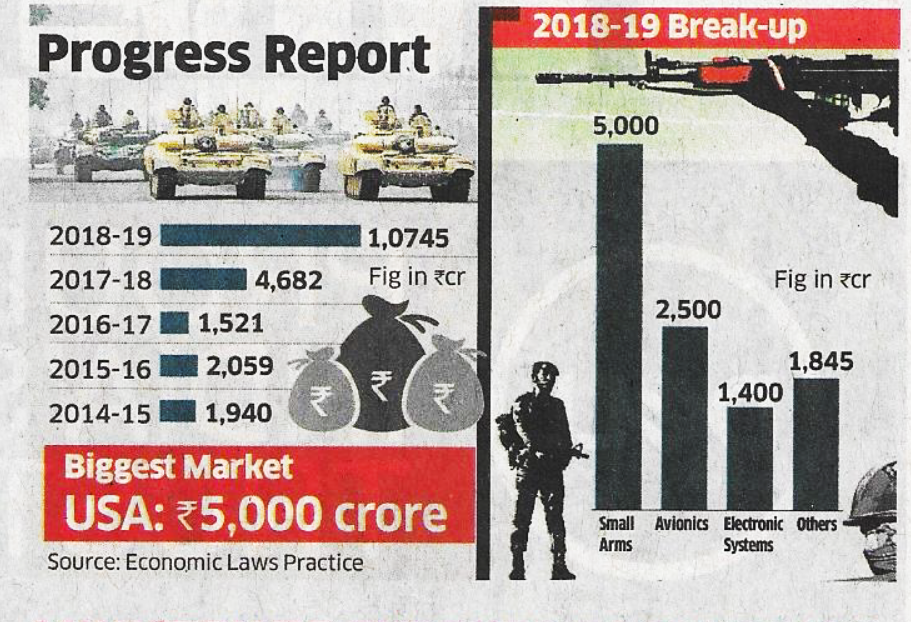

Indian Defence Market - The Opportunity

11 Feb 2019 |

Read More

India & The US - The Way Forward in the Defence Industry

11 Feb 2019 |

Read More

India & Israel - Strategic Collaborations in the Defence Industry

11 Feb 2019 |

Read More

India’s proposed offset policy: Can it be the new dawn?

29 Jun 2018 |

Read More

Amendments to Defence Procurement Procedure 2016

5 Feb 2019 |

Read More

Budget 2019: Judicial Reform Is What This Economy Needs Now

2 Feb 2019 |

Read More

ELP Defence & Aerospace Quarterly Update

4 Feb 2019 |

Read More

Interim Union Budget 2019 - An Analysis

1 Feb 2019 |

Read More

Wassenaar Arrangement - Updated List of Advisory Questions 2018

28 Jan 2019 |

Read More

The Indian Defence & Aerospace Sector : Challenges in the Opportunity

10 Nov 2018 |

Read More

ELP Defence & Aerospace Update

9 Oct 2018 |

Read More

ELP Knowledge Series - India Update Part 2 of 2018

10 Sep 2018 |

Read More

Notification on Drones Regulation in India

29 Aug 2018 |

Read More

ELP Defence & Aerospace Update

29 Jun 2018 |

Read More

ELP Knowledge Series - India Update Part 1 of 2018

14 Jun 2018 |

Read More